Bitcoin is an innovative technology that offers several benefits, such as fast transaction speeds, low costs, and eliminating the need for a third-party intermediary to process transactions.

Unfortunately, Bitcoin has faced resistance from regulators because the technology has been used for nefarious purposes, including online drug purchases and Ponzi schemes.

Initially, human beings exchanged goods. Whenever someone had a good that someone else needed and there was a good that was wanted in return, the exchange was made.

But the exchange could also be done for an unwanted good as long as this could later be exchanged with someone who needed it, thus opening the range of people involved.

It also emerges the hypothesis that someone does not currently have a good for exchange but remains in debt until they achieve the desired good, thus giving rise to the credit. The introduction of money has facilitated this process.

Related: Stay Positive With These Funny Crypto Memes.

The movement of money has evolved over time, thanks to various forms of the transaction – currency, banking transactions, credit cards, etc.

The increasing digitalization of society and a certain liberal perspective of society led to the emergence of electronic money. The history of virtual currency is full of examples that have not survived and some are only academic proposals. Others, on the other hand, have even been implemented and currently exist.

Check these funny crypto quotes: One Coin To Rule Them All! Crypto And Bitcoin Quotes.

Historical Developments of Money

There are three primary functions of money:

- medium of exchange

- unit of account

- store of value.

In the following, we explain briefly what constitutes money and how the different payment methods evolved over time. We may divide the historical developments of money into the following stages:

Barter System

Since the beginning of time, people used to barter. They were trading and exchanging goods and services for other goods and services. This method of payment created a lot of difficulties as it was very complex and inefficient.

Commodity Money System

In the barter system, it often happened that people could not agree on the measurement and valuation of goods, or they don’t want to take what other people want to give them in exchange. To solve the problems of the barter system, the commodity money system was created. In the commodity money system, people had selected a few commodities which are widely used and easily available.

You might like this article: Ace Of Crypto. Funny Cryptocurrency Jokes, Quotes, And Memes.

They were using those commodities as a medium of and exchange and means of payment. In different times and in different places, they have used different kinds of commodities such as salt, wheat, seeds, cattle, and tobacco, etc. However, it would not be easy but extremely difficult to carry the bags of salt and wheat every time.

Metallic Money system

To solve the problems related to commodity money, people moved towards the metallic money system in which certain metallic especially gold and silver, were used as a medium of exchange.

This system was lasting for a long time, but it evolved over time through the following different stages:

- Gold and silver were used as a medium of exchange in their different forms, and there were not specific coins. The value of gold and silver were being measured on the basis of weight.

- They made the proper coins of gold and silver. The face value of these coins was equivalent to the real value of gold and silver. This is called Gold Specie Standard.

- In some jurisdictions, the bimetallic system was adopted. In this system, the coins of both gold and silver were used simultaneously. The exchange rate was determined officially when they were exchanged with each other.

- At that time, it was not easy to save gold and silver from theft. Therefore, people started to keep their gold and silver at jewelry dealers for safekeeping purposes. The jewelry dealers gave receipts to owners, and the owners could redeem the receipts for their gold and silver. As the notion of keeping gold and silver at jewelry dealers became popular, people began using the receipts themselves (pieces of paper) in their daily trades rather than directly using the gold or silver they represented. 5. The acceptance of receipts for payment in the marketplace gave birth to commodity-backed money. Banks began issuing pieces of paper which was 100% backed by gold. In other words, pieces of paper could be replaced with gold on demand. This system is called the Gold Bullion Standard.

Fiat money

In 1971, the United States President Nixon issued a series of “temporary” economic measures in which he canceled the direct convertibility of US dollars into gold. This effectively ended the convertibility of fiat money back into gold. As such, the gold-backed money was replaced by non-convertible fiat money.

Central banks began issuing pieces of papers (also called paper money) in various denominations. Central banks force acceptance of by legal tender laws, which oblige all people within a jurisdiction to accept non-convertible fiat money as payment for goods or services and settlement of debts. The legal tender laws do not allow people to refuse legal tender money in favor of any other form of payment. In today’s world, the wide majority of all national currencies are non-convertible fiat currencies.

History and Development of Bitcoin & Cryptocurrency

Digital cash and payment through electronic money have gained popularity after the computer system is adopted by the mainstream banking industry. However, this system relies on a payment network, the infrastructure required to manage payments and avoid multiple spending using the same funds has always been costly and managed through a centralized banking network. A central server, therefore, ensures that funds are spent only once. In this system, the people have to transact based on regulated and controlled precepts that may be used to manipulate the value of currencies and the wealth of individuals.

It is argued that if individuals were able to transact freely between themselves through a peer to peer network, this would allow society itself to determine the value of their currency. This would require a database that is able to record individual transactions with levels of encryption that make it impossible to manipulate, amend or steal. This has given rise to blockchain technology that achieves all these goals and more provides a platform for the legitimacy of an instrument that can be recorded and recognized as a digital medium of exchange or cryptocurrency.

What is Cryptocurrency

The word “crypto” refers to the encryption or cryptography that the instrument is built on and then added to a blockchain database. The “currency” here refers to the recognition as a medium of exchange amongst its users.

The European Central Bank explains virtual currency in its published document as “a digital representation of value that is neither issued by a central bank or a public authority, nor necessarily attached to a fiat money or currency, but is accepted by natural or legal persons as a means of payment and can be transferred, stored or traded electronically”. Examples of virtual currencies include cryptocurrencies such 3 as Bitcoin, Litecoin, Stellar, and so on, but also include non-crypto currencies like in-game credits for in massively multiplayer games such as World of Warcraft; advertiser issued credits; and various other digital stored value systems.

The idea of digital monetary systems dates back to the early 1990s, when several companies and programmers tried their hand at creating money meant to be exchanged virtually. Many of these early currencies struggled to find their footing due to prohibitive regulation, insufficient technology, poor security features, lack of adoption, and a slew of other issues. The cryptocurrency segment of the digital currency universe was created in 2009 with the invention of Bitcoin.

Bitcoin

Bitcoin is a digital currency with no central issuing authority or physical form. More specifically, Bitcoin is a cryptocurrency that uses cryptography techniques to guide encryption protocols that identify ownership and verify transaction details. The Bitcoin encryption protocol was outlined by the entity Satoshi Nakamoto (2008) Nakamoto designed Bitcoin to ultimately create 21 million bitcoins as rewards for solving mathematical algorithms (necessary to maintain the bitcoin ledger) in a process called mining. Once mined, every bitcoin—or fraction thereof—can be sold, used as payment for retail purchases, or kept as an investment to be traded later.

Bitcoin is bought and sold on trading websites known as “exchanges,” each of which is independently operated and accessible 24/7 to a global clientele in much the same way as conventional foreign exchange trading and brokerage platforms.

4 The following characteristics of bitcoin are explained by its advocates:

- The decentralized nature of Bitcoins eliminates the prospect of government control or ownership. Further, only a finite amount of bitcoin (21 million) is available. Thus, no governing body or entity can artificially manipulate bitcoin value through an increase or decrease in currency production or other means. This leaves bitcoin value largely to the laws of natural supply and demand economics.

- The blockchain is a permanent public record of all confirmed transactions that occur in the system and an integral part of the Bitcoin ecosystem. The blockchain helps promote order and transparency while preventing counterfeiting.

- Digital payments to individuals and merchants can occur at any time, are processed faster, and incur lower fees. This is due in large part to removing banks and other intermediaries from the transaction processing flow.

- Although all Bitcoin transaction details are stored publicly, the identities of the users involved remain relatively anonymous. Bitcoin doesn’t offer the complete anonymity of cash but is certainly a far more private experience than making online payments or transactions using debit or credit card.

Blockchain

The basis of the Bitcoin platform is a technology called a blockchain. The blockchain turned out to be the golden goose of the Bitcoin platform. Blockchain is a new innovative technology that will change how financial institutions transact business in the financial services system. So here are five key points:

- Distributed ledger technology is more than Bitcoin, and the words blockchain and distributed ledger apply to a broad set of related technologies. There are many use cases for these technologies completely apart from cryptocurrency.

- A shared distributed ledger is a linked set of mirrored transaction records. For the accountants who are reading this, it is like double ledger entries on steroids. Imagine a ledger system that is simultaneously maintained by a thousand notaries for every transaction.

- All transactions on a distributed ledger are independently verified by the participants on the network and then stored in the ledger individually.

- The decentralized nature of these technologies offers the ability to remove the intermediaries and allows anyone to participate, so long as they follow the rules established by the protocols. An analogy can be found on the internet itself: initially, it was only a closed, private group of a few universities and government institutions; but the internet eventually became open and decentralized so that now, anyone can participate and benefit from using the internet.

- Removing the intermediaries will increase efficiency and security.

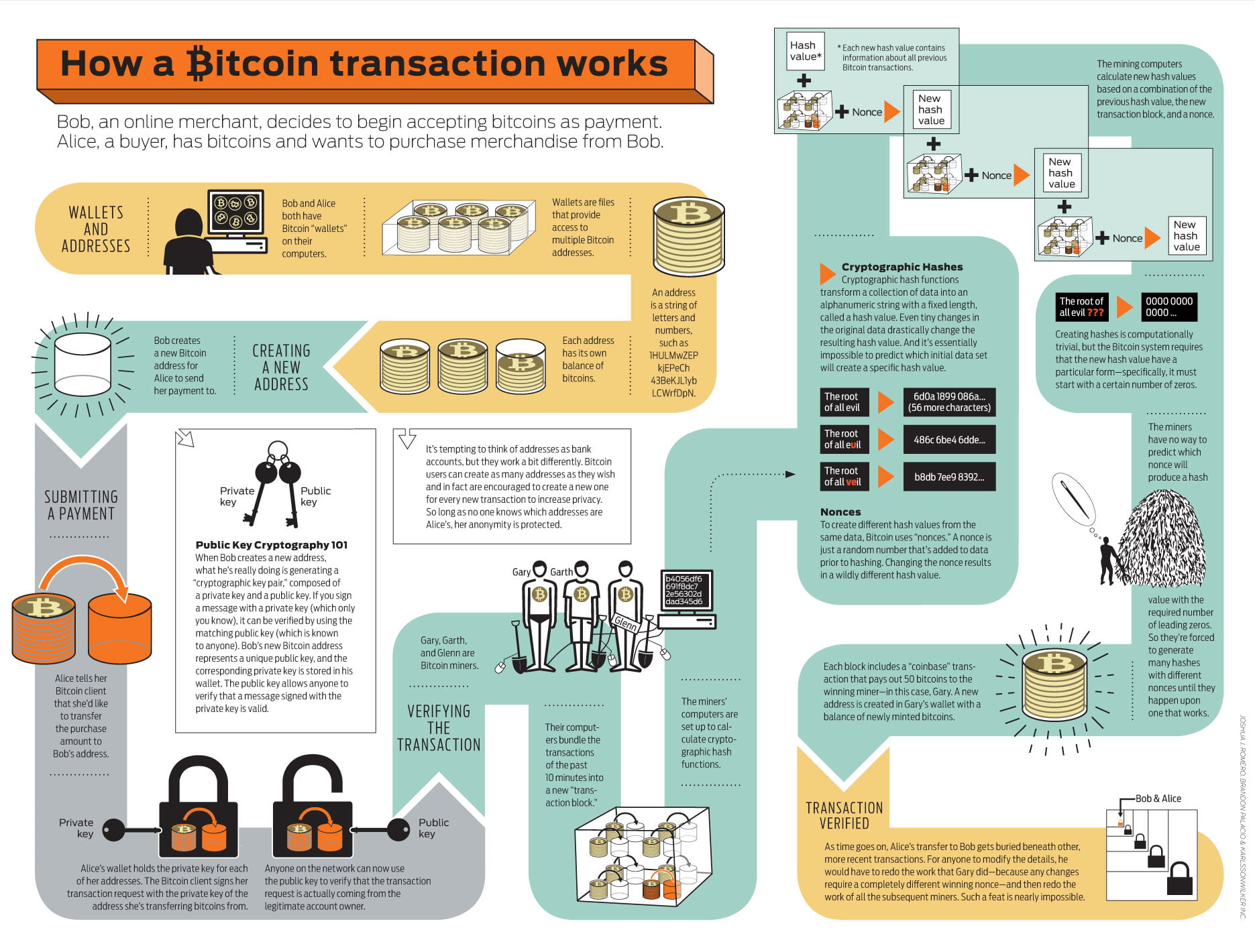

How Does Bitcoin Work?

From a user perspective, bitcoin is nothing more than a mobile app or computer program that provides a personal bitcoin wallet and allows a user to send and receive bitcoins with them.

Behind the scenes, the bitcoin network shares a public ledger called the “blockchain.” This ledger contains every transaction ever processed, allowing a user’s computer to verify the validity of each transaction. The authenticity of each transaction is protected by digital signatures corresponding with the sending addresses, allowing all users to have full control over sending bitcoins from their own Bitcoin wallets.

In addition, anyone can process transactions using the computing power of specialized hardware and earn a reward in bitcoins for this service. This is often called “mining”. An address is like a bank account into which a user can receive, store, and send bitcoins. Instead of being physically secured in a vault, bitcoins are secured with public-key cryptography.

Each bitcoin wallet has a private key, which the owner must keep secret. With this private key, the user can create any number of public keys, which can be used to create public addresses where the user can receive money into that wallet.

Anyone can send bitcoins to any address, but only the person with the private key can spend the bitcoins inside that wallet. While bitcoin addresses are public, it’s not automatically possible to knows which address belongs to which person; in this way, Bitcoin addresses are pseudonymous.

The sender of bitcoin broadcasts the transaction details to other members of the network. Other members in the network verify the published transaction details, and if the transaction appears valid, the transaction is incorporated into the blockchain.

As an example transaction, if you want to buy cupcakes from Cups and Cakes Bakery in San Francisco, then you need the public address of their wallet. After entering the amount and the destination address in your wallet software, your wallet will broadcast the transaction to the network.

This transaction is published on the peer-to-peer bitcoin network where it is validated with various checks – such as if your wallet has sufficient balance – and it propagates to all of the other members of the network. The transaction is eventually received by a miner, who incorporates the transaction into a block. This block is then flooded into the network and is incorporated into the global blockchain. The bitcoins now belong to Cups and Cakes Bakery’s wallet identified by the address you sent the bitcoins to.

Bitcoin On Illicit or Illegal Use

It is also commonly argued that Bitcoin and other cryptocurrencies are widely used for money laundering and other illegal purposes.

In general terms, the use of something lawful for an unlawful purpose does not make the thing itself become unlawful.

On this point, it is especially noteworthy that all fiat currencies are used for illegal purposes such as money laundering, fraud, and illegal commerce. It is readily acknowledged that the US Dollar is the most widely used currency for money laundering and other illegal purposes.